Predicted CLV model¶

Predicted customer lifetime value predicts the total value of all orders a customer is likely to make if they return to make another purchase during the next 365 days.

Amperity models predicted customer lifetime value (CLV) by comparing what customers spent in the previous year to their predicted spend in the coming year, and then predicts for each customer their:

Probability of purchase

Number of orders

Average order value

You can use predicted CLV modeling to build high-value audiences that identify:

Which customers have the highest predicted value?

Which customers will respond better to special offers and perks?

What are the best personalized experiences for your top customers, such as personalized rewards, offers, and content?

Which customers have individual price preferences?

Use cases¶

The predicted CLV model helps you identify your highest value customers by year or by value tier:

How much will customers spend?¶

The Predicted CLV Next 365 Days attribute in the Predicted CLV Attributes table contains the total predicted customer spend over the next 365 days. You can access this attribute directly from the Segment Editor.

After you select this attribute you can specify the type of values you want to use for this audience, such as:

Predicted CLV is greater than $100

Predicted CLV is less than $400

Predicted CLV is between $100 and $400

Which customers are the most valuable?¶

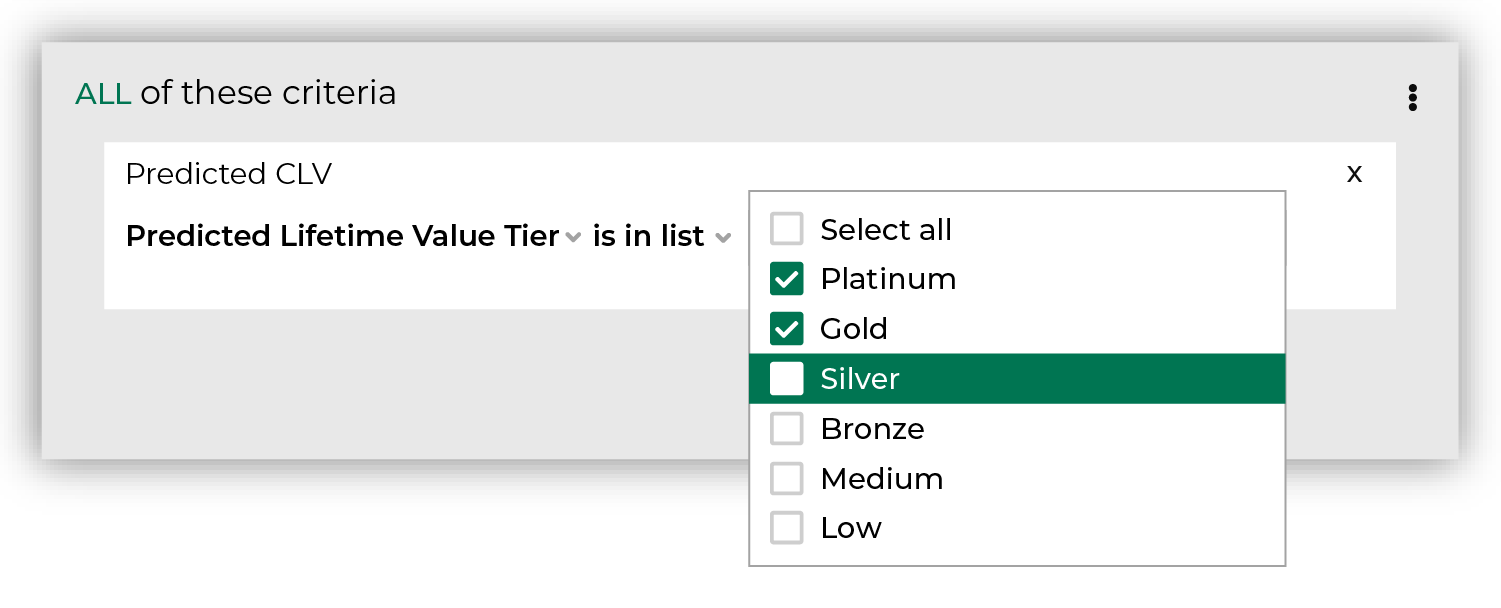

When predictive modeling is enabled for your tenant you can use output from the predicted customer lifetime value (CLV) model, which helps you identify your highest value customers by value tier. Each tier represents a percentile grouping of customers by predicted value:

Platinum represents the top 1%

Gold represents customers who fall between 1% and 5%

Silver represents customers who fall between 5% and 10%

Select all three of these predicted value tiers to build an audience that contains customers who are predicted to be in your top 10% (inclusive) high value customers.

The following sections describe using the Segment Editor to build a segment that returns customers who are predicted to be your top 10% highest value customers.

Which customers are predicted to be in your top ten percent?

|

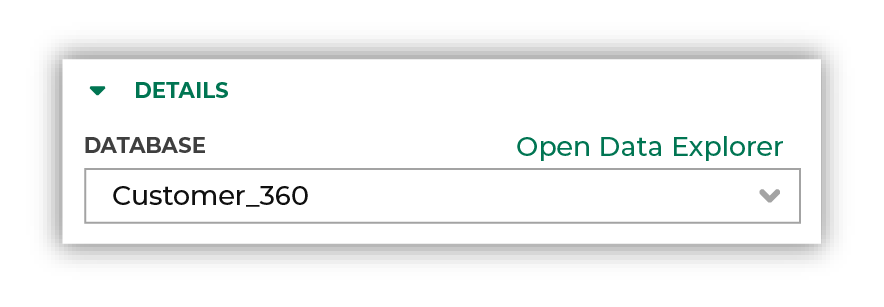

Open the Segment Editor, look in the lower-right of the page and make sure your customer 360 database is selected.

|

|

The first step is to identify customers whose predicted customer lifetime value is platinum, gold, or silver. Choose the Predicted Customer Lifetime Value Tier attribute from the Predicted CLV Attributes table, select the “is in list” operator, and then select “Platinum”, “Gold”, and “Silver” from the list:

Click the Refresh button located on the right side of the Segment Editor to see how many customers are in your segment, how much they spent in the past year, how many are active, and how many of them should belong to a future campaign. |

|

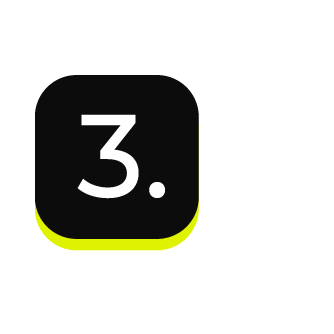

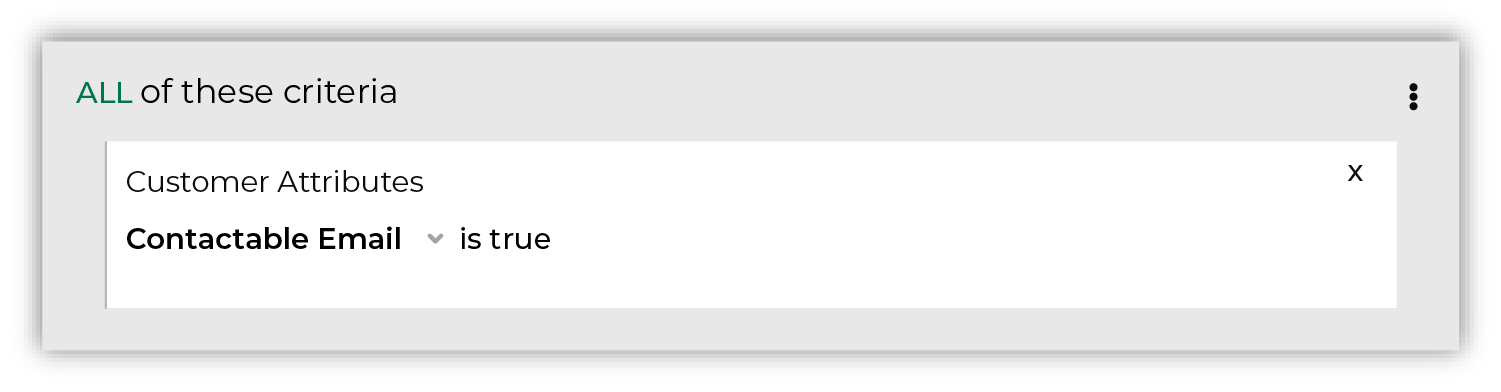

The next step is to identify customers with contactable email address in their customer profiles. Choose the Contactable Email attribute from the Customer Attributes table, and then select the “is true” operator:

Keep the slider set to AND. Click the Refresh button located on the right side of the Segment Editor to view updated values for the combination of customers who have a predicted platinum, gold, or silver and a contactable email address. Tip Use the Is Opted Into Email attribute from the Customer Attributes table to include only customers who are opted into receiving email messages from your brand.

|

|

Send this list of customers to your favorite email marketing tool, such as Attentive or Braze, on the Campaigns page. |

|

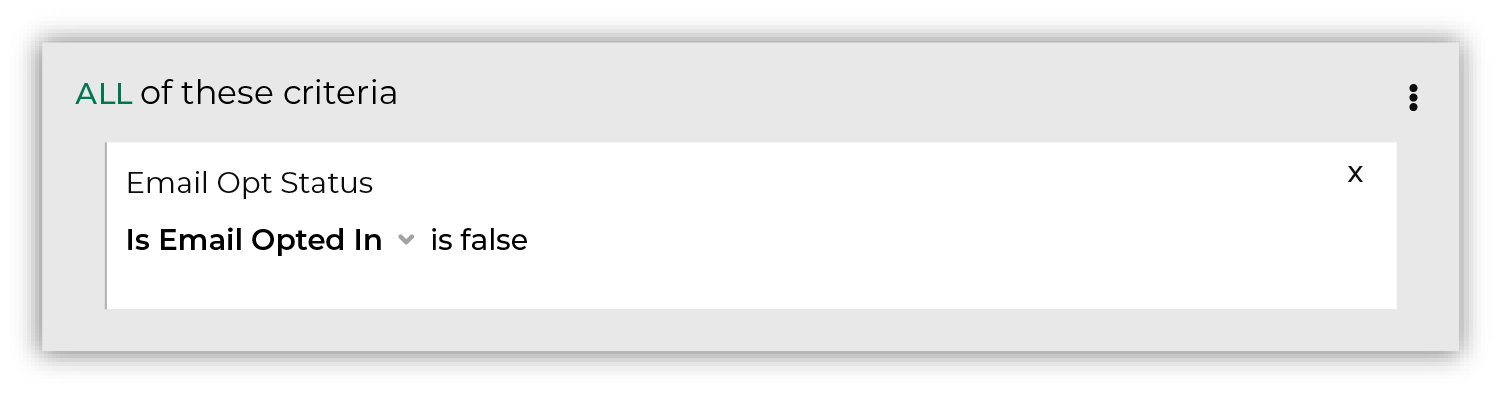

You are done building your audience. Click the Save As button in the top right corner of the Segment Editor. Give your segment a name that describes the purpose and audience type for the segment. For example: “Predicted Top 10% High Value Customers”

Tip Use good naming patterns to ensure that you can always find your segments when you need them. Be sure to include the brand name or the region name if you have multiple brands or have multiple regions and want to build segments that are brand- or region-specific. |

|

After your segment is saved the Segment Overview page opens and shows additional details, such as historical and predicted revenue, the percentage of customers that are reachable by email, by phone, on Facebook, and customer trends, such as purchases by channel, revenue by lifetime spend. |

Build a predicted CLV model¶

You can build a predicted CLV model from the Customer 360 page. Each database that is a “customer 360” database and contains the Merged Customers, Unified Itemized Transactions, and Unified Transactions tables may be configured for predictive modeling. You may use other tables in that database that are unique by Amperity ID to extend predictive models.

Important

The churn, pCLV, and affinity models start with a set of fields from the Merged Customers, Unified Itemized Transactions, and Unified Transactions tables from the database in which the model is built. EPM uses fields from Merged Customers, as well as the custom input tables selected during configuration.

The churn and pCLV models support custom input tables for transactions and transaction items. These tables should have the same field names as Unified Transactions and Unified Itemized Transactions, but can have custom logic, such as filtering or aliasing, depending on the data your brand wants to use to model churn and pCLV.

You may customize predictive models, such as excluding certain types of customers and adding custom features that support your brand’s use cases. Customer exlusions are based off of the Customer Attributes table, and custom features are based off of additional fields that may exist on Unified Itemized Transactions.

You do not need to configure the following fields:

Table |

Fields |

|---|---|

Merged Customers |

Predictive models always use the following fields in the Merged Customers table:

|

Unified Transactions |

Predictive models always use the following fields in the Unified Transactions table:

The following fields, when they are available in the Unified Transactions table, will also be used:

|

Unified Itemized Transactions |

Predictive models always use the following fields in the Unified Itemized Transactions table:

|

To build a predicted CLV model

|

Open the Customer 360 page, select a database, and then open the bottom– –menu and select Predictive models. This opens the Predictive models page. |

|

Next to Predicted customer lifetime value (pCLV), click Add model. This opens the Predictive enablement page for predicted CLV models. Note Churn propensity and predicted CLV are both outputs of the predicted customer lifetime value (pCLV) model. Fields that support both models are available to queries, segments, and campaigns from the Predicted CLV Attributes table. |

|

Choose the model start date, which is the date from which the pCLV model starts tracking customer purchase behavior. You may choose a calendar date, such as specific date like January 1, 2025 or you may choose a relative date like “today - 4 years”. A model that uses a calendar date will always use data from that date to the present day. Over time the time window used by the model will get longer. A model that uses a relative date will always have a time window with a consistent length. Over time the time window used by the model will stay the same. Note A relative date is determined at the time a model is run, where “now” is the date on which the model is run. The time window should be at least 3 years, but may be 4 or 5, depending on how much data is available to the model in Amperity. |

|

Select the tables from which order-level and item-level data is made available to the model. For order-level data, select Unified Transactions. For item-level data, select Unified Itemized Transactions. |

|

Use the Prediction horizon field to specify the number of days into the future for which you want pCLV modeling. The default value (“365”) is fine for most use cases. |

|

Use the Customer exclusions field to use fields in the Customer Attributes table to identify customers who have purchase patterns that should be excluded from pCLV modeling. For example, use cases for customer exclusions include:

Note The list of fields in the Customer Attributes table that may be used for pCLV modeling are listed in the dropdown. Not all fields in the Customer Attributes table may be used with pCLV modeling. |

|

Use the Additional features field to add more fields from the Unified Transactions and Unified Itemized Transactions tables to the pCLV model. For each additional feature, the model results will include features for “first”, “last”, and “most common”. For example, if Product Category is added, the pCLV model results will include features for First Purchase Product Category, Last Purchase Product Category, and Most Common Product Category. |

|

Click Start validation. |

Use in segments¶

The following table describes the fields that are available when using predicted customer lifetime value (CLV) modeling in segments.

Column name |

Data type |

Description |

|---|---|---|

Amperity ID |

String |

The unique identifier assigned to clusters of customer profiles that all represent the same individual. The Amperity ID does not replace primary, foreign, or other unique customer keys, but exists alongside them within unified profiles. Note The Amperity ID is a universally unique identifier (UUID) that is 36 characters spread across five groups separated by hyphens: 8-4-4-4-12. For example: 123e4567-e89b-12d3-a456-426614174000

|

Days Since Last Order |

Integer |

The number of days elapsed since the customer’s last order. |

Historical Order Frequency Lifetime |

Integer |

The total number of historical orders a customer has made. |

Predicted Average Order Revenue Next 365D |

Decimal |

The predicted average order revenue over the next 365 days. |

Predicted CLV Next 365D |

Decimal |

The total predicted customer spend over the next 365 days. |

Predicted Customer Lifecycle Status |

String |

A probabilistic grouping of a customer’s likelihood for future transactions. For repeat customers, groupings include the following tiers:

For one-time buyers, groupings include the following tiers:

|

Predicted Customer Lifetime Value Tier |

String |

A percentile grouping of customers by predicted CLV. Groupings include:

Note This attribute returns only the customers who belong to the selected value tier. For example, to return all of your top 10% customers, you must choose platinum, gold, and silver. Silver by itself will return 5% of your customers, specifically those are in your 5-10%. |

Predicted Order Frequency Next 365D |

Decimal |

The predicted number of orders over the next 365 days. |

Predicted Probability Of Transaction Next 365D |

Decimal |

The probability a customer will purchase again in the next 365 days. |