Approximate RFM¶

RFM is a method used to analyze customer value that represents three dimensions:

Recency. How recently did the customer purchase?

Frequency. How often does the customer purchase?

Monetary. How much does the customer spend?

Individual scores for recency, frequency, and monetary have a scale of 1-10. Combined RFM scores exist on a scale. “111” represents the lowest possible RFM score. “101010” represents the highest possible RFM score, or “three ‘10’ scores”. Higher scores represent preferred behaviors.

What is an RFM score?

An RFM score is an approximation that measures three data points:

A recency score (R) that sorts customers by how recently they purchased during the previous 12 months.

A frequency score (F) that sorts customers by purchase frequency during the previous 12 months.

A monetary score (M) that score that sorts customers by spend amount during the previous 12 months.

These individual scores can be combined into a single score (RFM).

Use approximate RFM (recency, frequency, monetary, and combined score) attributes to build segments that support many types of use cases.

Approximate RFM attributes include:

Attributes for recency, frequency, and monetary, the three components of an RFM score

Examples¶

The following topics contain examples of using approximate RFM scores:

RFM scores¶

Each RFM score is split into ten percentile groups. The lowest percentile is 1 and the highest percentile is 10. Each percentile represents 10% of the customers who belong to that segment.

10 represents the 90-100th percentile and the customers who have the highest recency, frequency, or monetary scores.

9 represents the 80-90th percentile

8 represents the 70-80th percentile

7 represents the 60-70th percentile

6 represents the 50-60th percentile

5 represents the 40-50th percentile

4 represents the 30-40th percentile

3 represents the 20-30th percentile

2 represents the 10-20th percentile

1 represents the 0-10th percentile and the customers who have the lowest recency, frequency, or monetary scores.

Tip

Combine percentiles to build larger groups of customers. For example 9 and 10 together represent the “top 20%” while 8, 9, and 10 represent the “top 30%”.

Recency, frequency, and monetary¶

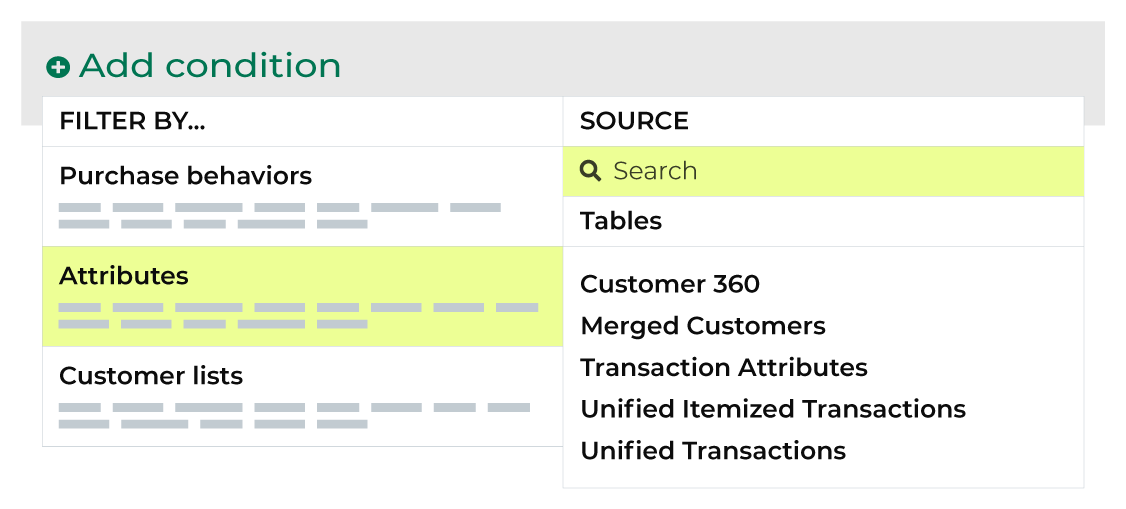

You can add RFM attributes to a segment from the Segment Editor. Click Add condition, and then choose Attributes.

Enter “L12M” into the search feature to filter the list of available attributes. Choose L12M frequency, L12M monetary, or L12M recency to add the attribute to a segment. Select an operator, and then finish defining the conditions for how this attribute should be applied to the segment.

L12M Recency¶

L12M Recency is a score that sorts customers by how recently they purchased during the previous 12 months.

To find customers who purchased most recently, start with the L12M Recency attribute, set its operator to is, and then specify a percentile. For example, use “10” to find customers who are in the top 10% for most recent purchases.

L12M Frequency¶

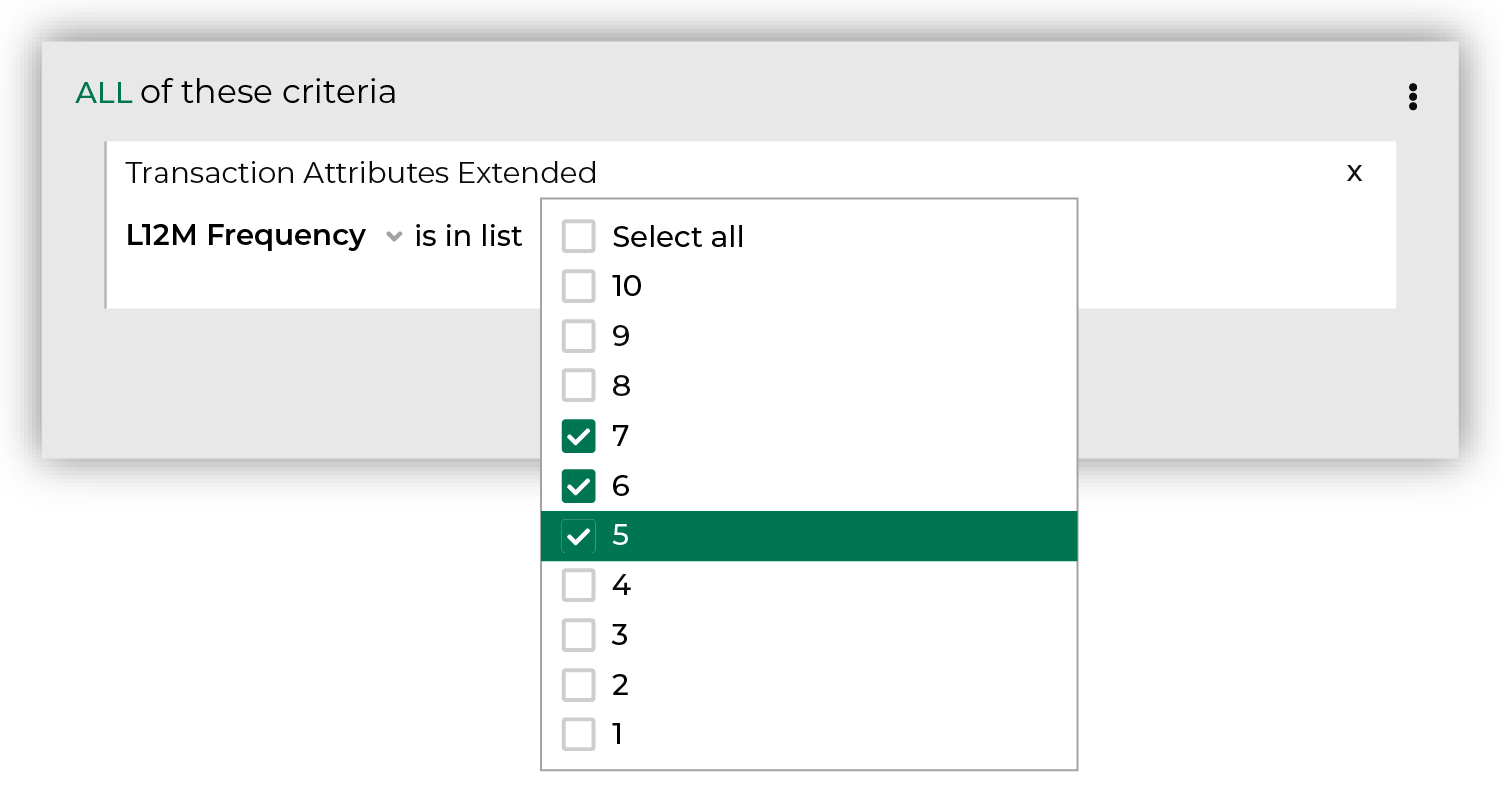

L12M Frequency is a score that sorts customers by purchase frequency during the previous 12 months.

To find which customers purchased most frequently during the previous 12 months, start with the L12M Frequency attribute, set its operator to is in list, and then specify percentiles. For example, use “10” and “9” to find customers who are in the top 20% for purchase frequency.

L12M Monetary¶

L12M Monetary is a score that sorts customers by spend amount during the previous 12 months.

To find customers who spent the most money during the previous 12 months, start with the L12M Monetary attribute, set its condition to is, and then specify a percentile. For example, use “10” to find customers who are in the top 10% for spend amount.

Combined score¶

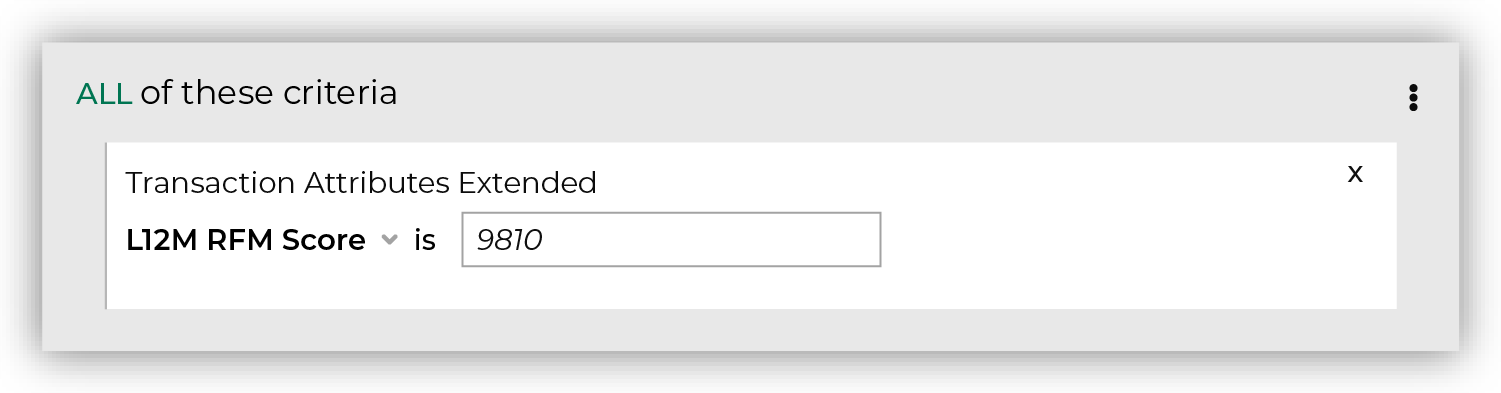

The RFM score for the customer is based on transactions that occurred within the last 12 months. The RFM score is represented as an integer between “111” and “101010”. This is a concatenated score that uses each of the individual recency, frequency, and monetary scores. The order is recency, then frequency, and then monetary.

For example, you can build an audience that contains your top 20% customers for recency, your top 30% customers for frequency, and your top 10% customers for monetary by setting the L12M RFM Score attribute to “9810” (or “9” for recency, “8” for frequency, and then “10” for monetary).

Note

Unlike the individual RFM score attributes, the combined score for each attribute represents the lowest percentage group to include, and then includes all higher percentage groups. For example, if you set frequency to “8” it will return “8”, “9”, and “10”, or your top 30%.

This is different from the individual attributes where you could return your middle 30% by setting the L12M Frequency attribute to “5”, “6”, and “7”.

You can access combined approximate RFM scores directly from the Segment Editor. To add this attribute to your segment, To add these attributes to your segment, click Add condition and then Add attribute. Select the Transaction Attributes Extended source, select the L12M RFM Score attribute, and then apply an condition.

Available operators¶

The following table lists the operators that are available to these attributes.

Note

These attributes have an Integer data type. All Integer data types share the same set of operators. Recommended operators for this attribute are identified with “ More useful” and operators with more limited use cases are identified with “ Less useful”.

Operator |

Description |

|---|---|

is |

Returns customer records with an approximate RFM score that matches the specified score. |

is between |

Returns customer records with an approximate frequency, monetary, or recency score that is between the specified scores, not including the specified score. |

is greater than |

Returns customer records with an approximate frequency, monetary, or recency score that is greater than the specified score, not including the specified score. |

is greater than or equal to |

Returns customer records with an approximate frequency, monetary, or recency score that is greater than or equal to the specified score, including the specified score. |

is in list |

Returns customer records with an approximate frequency, monetary, or recency score that matches the scores that are specified in the list. |

is less than |

Returns customer records with an approximate frequency, monetary, or recency score that is less than the specified score, not including the specified score. |

is less than or equal to |

Returns customer records with an approximate frequency, monetary, or recency score that is less than or equal to the specified score, including the specified score. |

is not |

Less useful Returns customer records with an approximate frequency, monetary, or recency score that does not match the specified score. |

is not between |

Less useful Returns customer records with an approximate frequency, monetary, or recency score that is not between the specified scores, not including the specified score. |

is not in list |

Less useful Returns customer records with an approximate frequency, monetary, or recency score that does not match the scores that are specified in the list. |

is not NULL |

Returns customer records that have a value. |

is NULL |

Returns customer records that do not have a value. |