Tax amounts¶

A tax amount is the total amount of taxes that are associated with the purchase of an item, an order, or a unit.

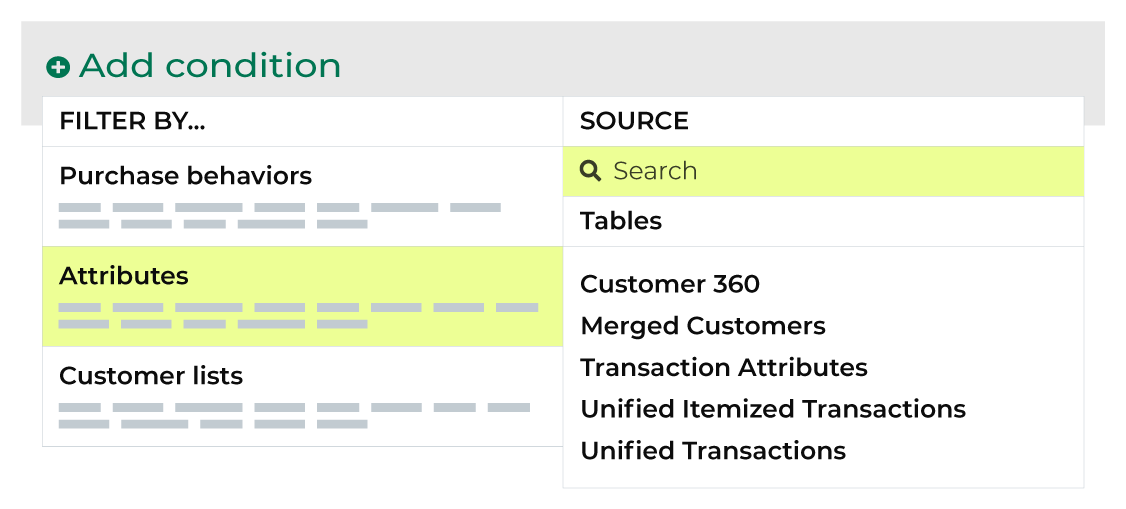

You can add tax amount attributes to a segment from the Segment Editor. Click Add condition, and then choose Attributes.

Enter “tax amount” into the search feature to filter the list of available attributes. Choose item tax amount, order tax amount, or unit tax amount to add the attribute to a segment. Select an operator, and then finish defining the conditions for how this attribute should be applied to the segment.

Available operators¶

The following table lists the operators that are available to tax amount attributes.

Note

Tax amount attributes have a Decimal data type. All Decimal data types share the same set of operators. Recommended operators for this attribute are identified with “ More useful” and operators with more limited use cases are identified with “ Less useful”.

Operator |

Description |

|---|---|

is |

Less useful Returns a specific tax amount, such as “3.33”, “4.33”, or “5.33”. Tip Use the following operators to return a range of tax amounts instead of a specific tax amount: is between, is greater than, is greater than or equal to, is less than, and is less than or equal to. |

is between |

More useful Returns a range of tax amounts that are between the specified tax amounts. |

is greater than |

More useful Returns tax amounts that are greater than the specified tax amount. |

is greater than or equal to |

More useful Returns tax amounts that are greater than or equal to the specified tax amount. |

is in list |

Less useful Avoid using the is in list condition; individual tax amounts are not typically made available in a list. |

is less than |

More useful Returns tax amounts that are less than the specified tax amount. |

is less than or equal to |

More useful Returns tax amounts that are less than or equal to the specified tax amount. |

is not |

Less useful Avoid using the is not condition. For example, if you specified “3.33” then any tax amount less than or equal to “3.32” and any tax amount greater than or equal to “3.34” would be returned. |

is not between |

Less useful Discovers outlier tax amounts. For example, if most of your tax amounts are between “3.33” and “5.33”, use “3.33” and “5.33” to return tax amounts that were less than and greater than those values. |

is not in list |

Less useful Avoid using the is not in list condition when tax amounts are not made available as a list. |

is not NULL |

Returns customer records that have a value, such as “3.33”, “4.33”, and “5.33”, but also “ “ (a space) and “0” (zero). If the record has any value it will be returned. |

is NULL |

Returns customer records that do not have a value. |